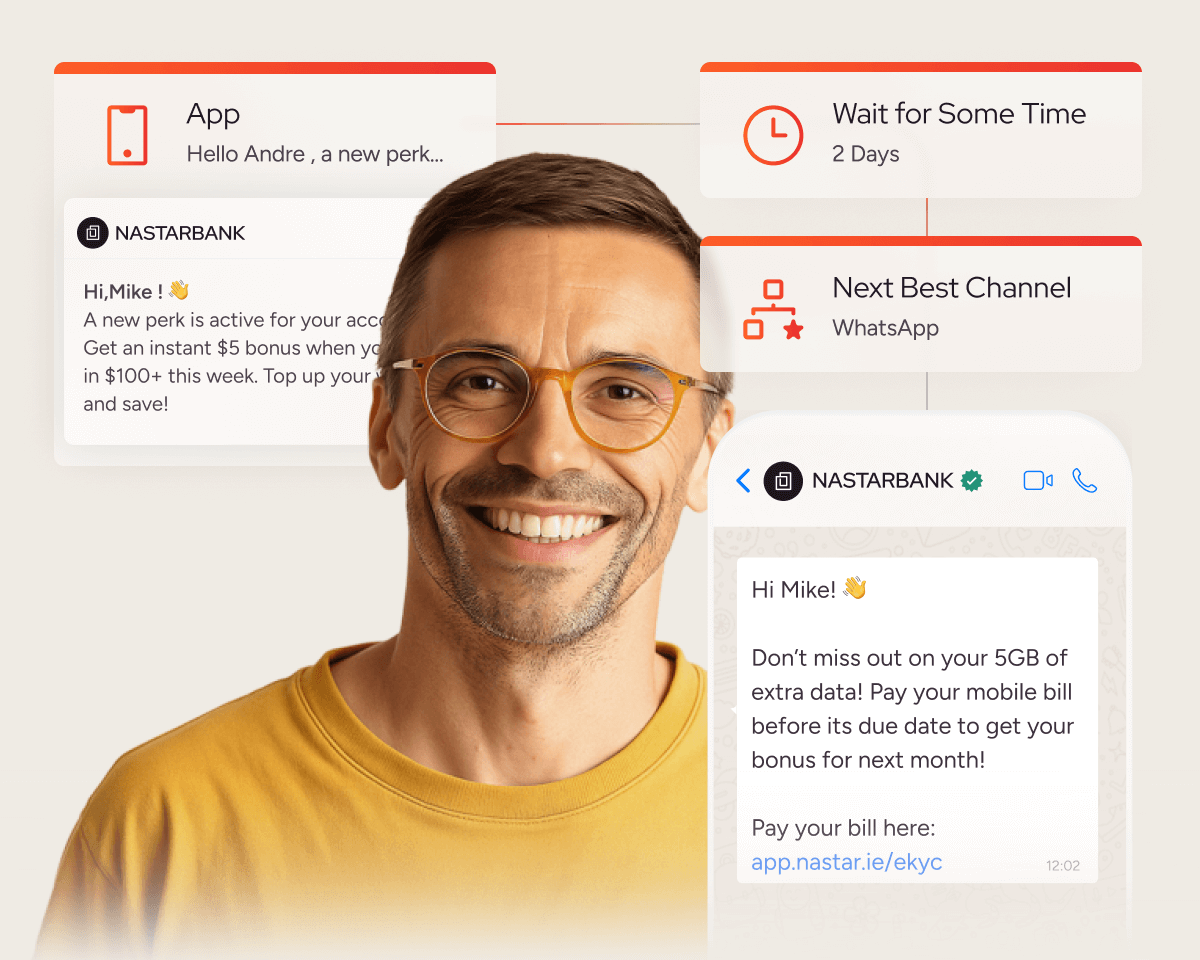

Uncompromising Security. Certified Compliance.

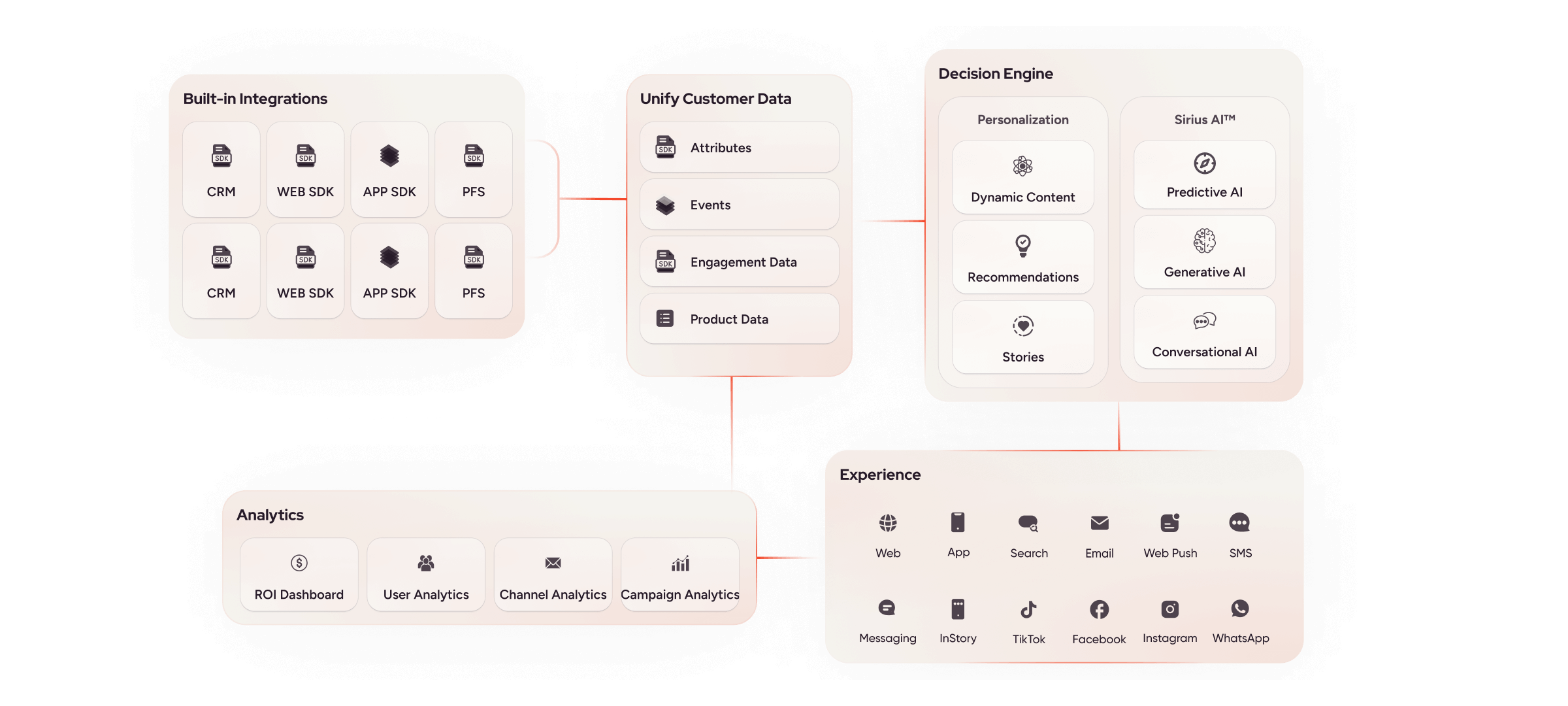

Strict regulations shouldn’t limit your growth. Trusted by over 1,500 global customers, our platform offers multi-layered security, featuring SSL encryption, robust API authentication, secure AWS hosting, and disaster recovery. With granular access controls and industry-leading certifications, we ensure full compliance with global standards like GDPR, CCPA, BNM RMiT, LGPD, and OJK, empowering you to build trust and lasting customer relationships.