From first click to repeat purchase, create experiences your customers will love

Build trust and loyalty with personalized experiences that increase engagement and retention

Inspire travelers, personalize the journey, boost bookings, and drive ancillary revenue

Explore 80+ self-guided demos, no forms, no waiting

Explore Insider One and become unstoppable. Take a self-guided tour of 80+ demos and use cases tailored to your role, goals, or industry. No forms. No delay

Discover the power of WhatsApp for business

60+ templates for seamless SMS marketing

Learn how to put your customer data into action

3X

increase

in leads

20%

faster sales cycles

17%

fewer eKYC drop-offs

Industry

Financial Services

Category

Cross-Channel Journey

Personalization

Customer Engagement

Channels

Email

SMS

Web

Push Notifications

Tools

Lead Scoring

CDP

Architect

“We switched from our previous provider to Insider to connect all digital data and touchpoints, cut eKYC drop-offs, and boost high-quality leads. In weeks, sales cycles were faster, acquisition costs lower, and customer trust and engagement at an all-time high.”

Senior Vice President, Performance Marketing

Why Insider

Generali selected Insider for its advanced compliance features, strong security standards, and proven ability to deliver personalized journeys at scale. Using Insider’s CDP, Generali connected disparate systems for a unified customer view, enabling engagement across preferred channels. Seamless integration and data-driven cross-channel journeys improved engagement and reduced eKYC drop-offs, supporting both immediate results and long-term growth.

Executive summary

Generali faced high CAC, repeated eKYC drop-offs, low digital activity, and poor platform stickiness, leading to lost revenue and weaker customer engagement. With Insider’s financial services expertise, secure local AWS hosting, and seamless CDP and CRM integration, Generali delivered personalized customer journeys across channels. These improvements drove 3X more leads, 20% faster sales cycles, 40% better onboarding, and 25% higher customer LTV.

About Generali

Generali is one of the largest insurance and asset management providers globally, serving 68 million customers in over 50 countries since 1831. Recent strategic reinvention has focused on efficiency, customer-centric innovation, and regulatory leadership.

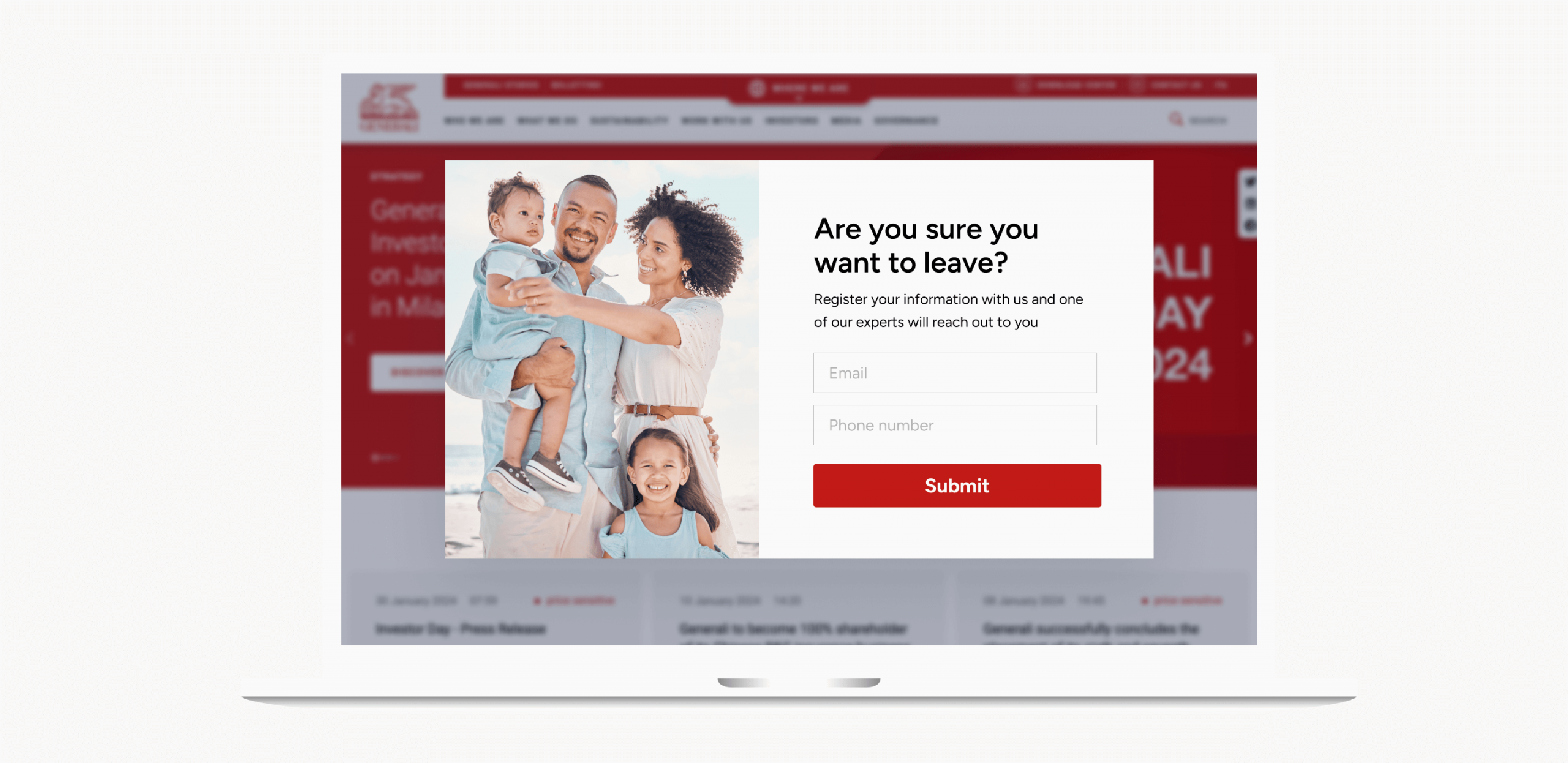

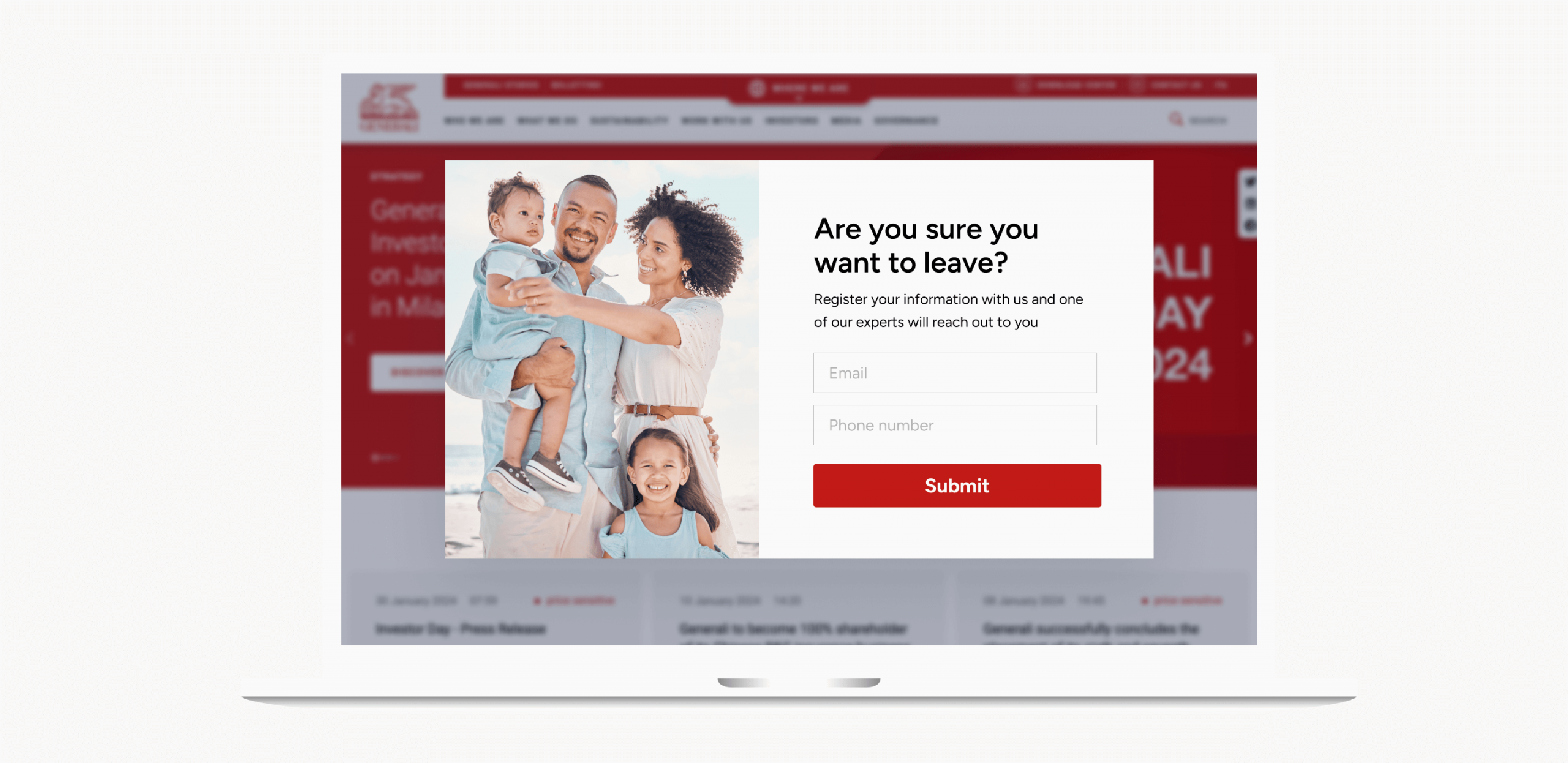

USE CASE #1

17% drop in eKYC drop-offs and 3X lead growth with gamified, personalized engagement

The challenge

Generali needed to not only lower CAC and collect high-quality leads but also reduce eKYC onboarding drop-offs and increase engagement among digitally inactive customers. Previous efforts with another provider left too many anonymous visitors unconverted and the platform underutilized, stalling growth and retention.

“We couldn’t believe how quickly Insider integrated with our systems. Their support meant we now run personalized, secure, and interactive experiences that keep customers engaged, not just signing up.”

Senior Vice President,

Performance Marketing

The solution

By integrating Insider’s CDP and CRM, Generali mapped behavior across all touchpoints while gamified overlays and memory-game templates turned passive site visits into interactive lead opportunities. AI-driven segmentation personalized banners for recently viewed products to nudge engagement and unlock powerful cross-sell and quote-to-policy experiences. Real-time onboarding status updates and compliance notifications assured digital trust and transparency.

The results

3X

increase in verified leads

17%

reduction in eKYC drop-offs

14%

improvement in policy conversion rates

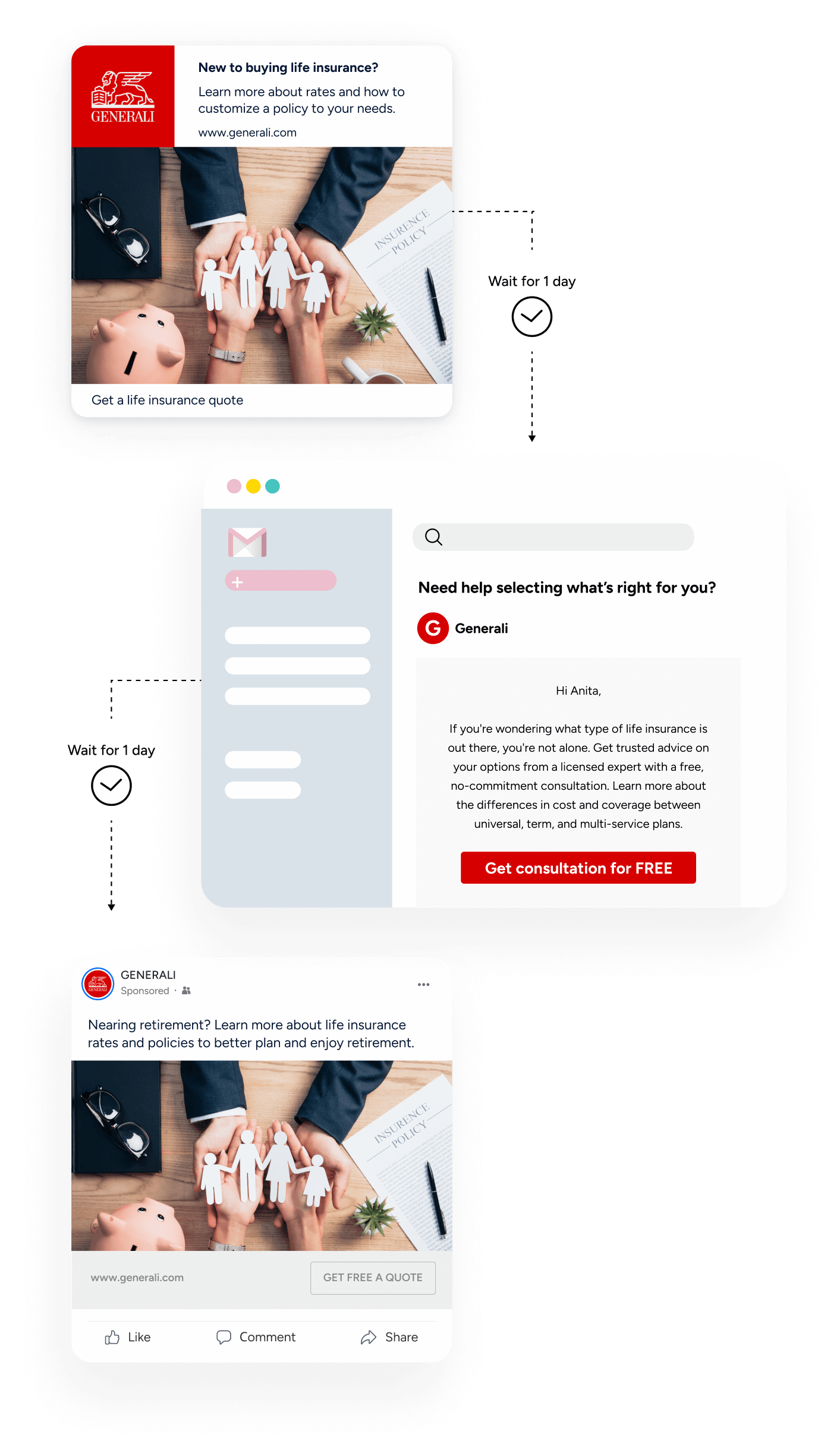

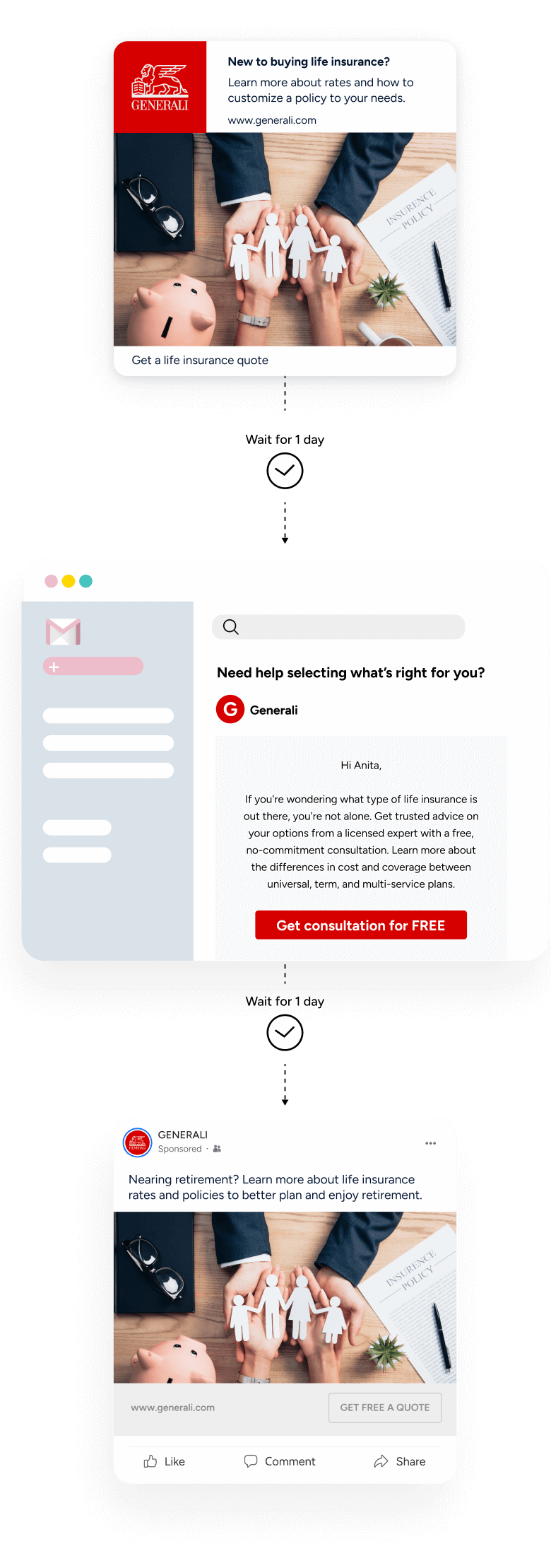

USE CASE #2

20% faster sales cycles and 25% higher CLTV with AI-led lead validation for reactivation

The challenge

Without automated lead validation or real-time alerts, Generali’s sales teams wasted time on cold leads, missed opportunities, and struggled to reactivate inactive customers. The lack of ongoing engagement tools resulted in low platform stickiness.

The solution

Insider’s multi-layered platform introduced AI-led lead scoring with behavioral signals, predictive Early Month on Book (EMOB) activation strategies, and personalized re-engagement plans to target low-score and inactive users, driving platform loyalty. CRM integration ensured the sales team could focus on high-intent and retained customers.

“Insider’s AI-powered lead scoring immediately stood out for its accuracy. Our sales team now spends far less time chasing unqualified leads and far more time engaging with customers who are ready to convert. That shift alone has made a dramatic difference in both our sales velocity and customer relationships.”

Senior Vice President, Performance Marketing

The results

20%

faster sales

cycles

25%

increase in average customer lifetime value

Summary

Generali replaced a legacy martech stack with Insider’s unified platform, achieving not only 3X lead growth and a 20% faster sales cycle, but also stronger customer trust, increased business results, and compliance with the industry’s highest regulatory standards. Gamified engagement, predictive retention tools, and secure data flows have powered sustainable growth and lasting customer relationships.

Looking ahead

Generali will deepen its use of AI-powered predictive segmentation, expand gamified engagement, implement increasingly rigorous compliance features, and deploy outcome-based customer support automation to retain, reactivate, and grow its customer base for the long term.

Favorite feature

Architect

Generali’s favourite feature is Architect, Insider’s Customer Journey Orchestration Platform, and its seamless, automated AI-driven lead scoring, combined with gamified overlays, making it effortless to identify and actively engage high-value, loyal customers across every channel.

Trusted by over 1,200 global brands

Want to learn what Insider can do for you?