From first click to repeat purchase, create experiences your customers will love

Build trust and loyalty with personalized experiences that increase engagement and retention

Inspire travelers, personalize the journey, boost bookings, and drive ancillary revenue

Explore 80+ self-guided demos, no forms, no waiting

Explore Insider One and become unstoppable. Take a self-guided tour of 80+ demos and use cases tailored to your role, goals, or industry. No forms. No delay

Discover the power of WhatsApp for business

60+ templates for seamless SMS marketing

Learn how to put your customer data into action

502%

increase in loan applications

192%

increase in credit

card applications

51%

increase in

search bar usage

Industry

Finance – Banking

Themes

Personalization

Experimentation

Omnichannel Journeys

Channels

App Push

App Personalization

Web Push

Web

Mobile Web

Tools

CDP

Sirius AI

Onsite Personalization

A/B Testing

InStory

“Insider’s advanced segmentation let us quickly deliver hyper-personalized banking offers to high-value segments, driving triple-digit growth in loan and credit card applications while enabling more precise, agile, and flexible personalization at scale.”

Senior Vice President, Digital Banking

Why Insider

BBVA partnered with Insider to deliver compliant, personalized banking experiences that resonate with every customer segment — from digital-savvy millennials to those aged 55+. Insider brought together a unified customer data layer, AI-powered predictive segmentation, and omnichannel personalization capabilities, enabling the bank to optimize every customer interaction with measurable business impact.

Executive summary

BBVA, a leading global financial institution, wanted to elevate engagement and conversion across its digital channels. With customer expectations for banking increasingly shaped by e-commerce and social media, the bank set out to provide hyper-relevant, context-aware experiences at every touchpoint. By partnering with Insider, BBVA was able to combine real-time behavioral data, advanced segmentation, and immersive content experiences to achieve triple-digit growth in critical product applications, while deepening customer engagement and loyalty.

About BBVA

Established in 1946, BBVA is one of the leading financial services groups, serving 18.5 million customers — including 9.2 million digital customers. The bank is recognized globally for blending advanced technology with personalized human service, earning awards such as “Best Consumer Digital Bank” and “Best Mobile Banking App” from World Finance Magazine.

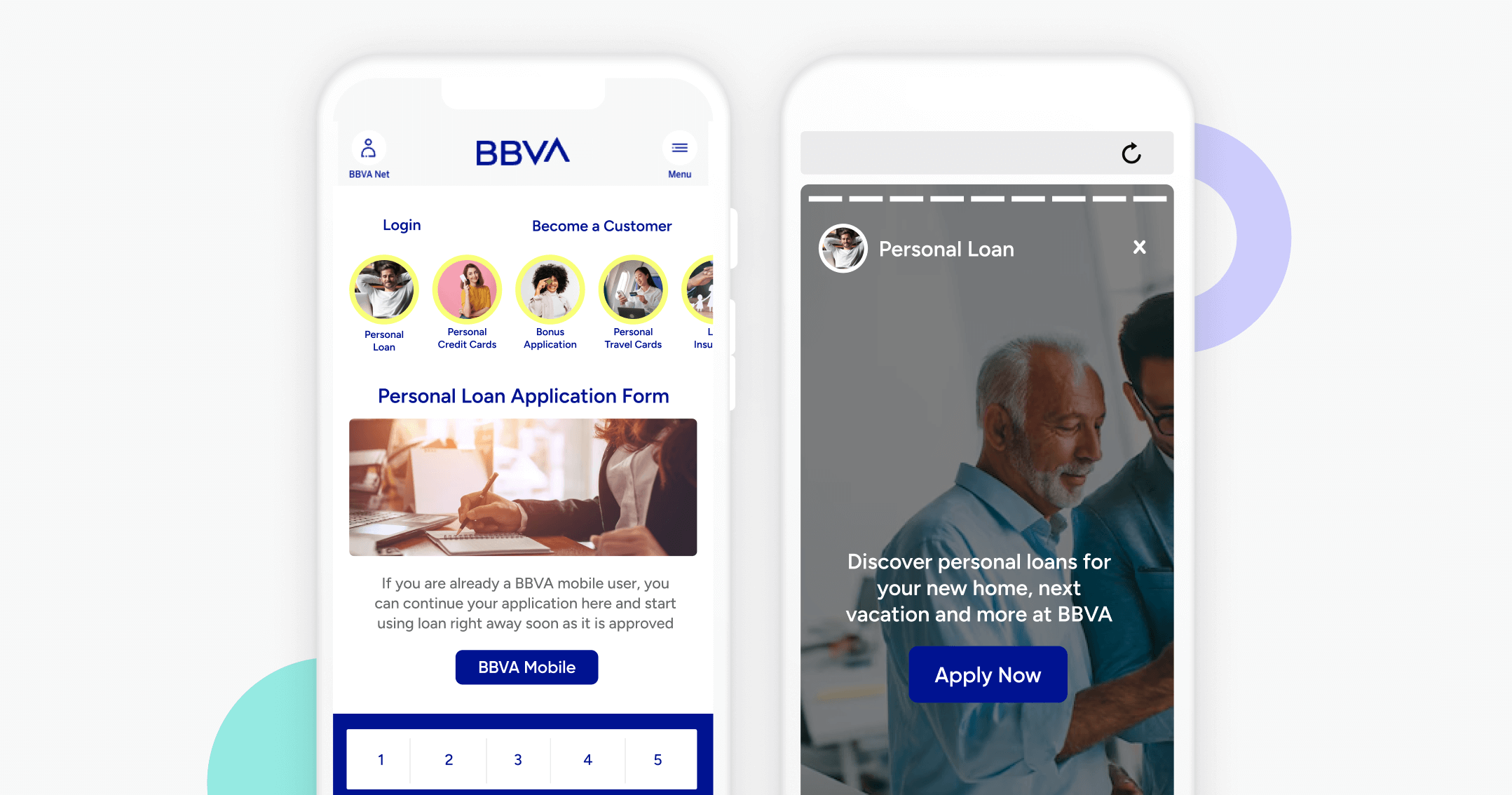

Personalized Homepage Drives 20% More Logins

The challenge

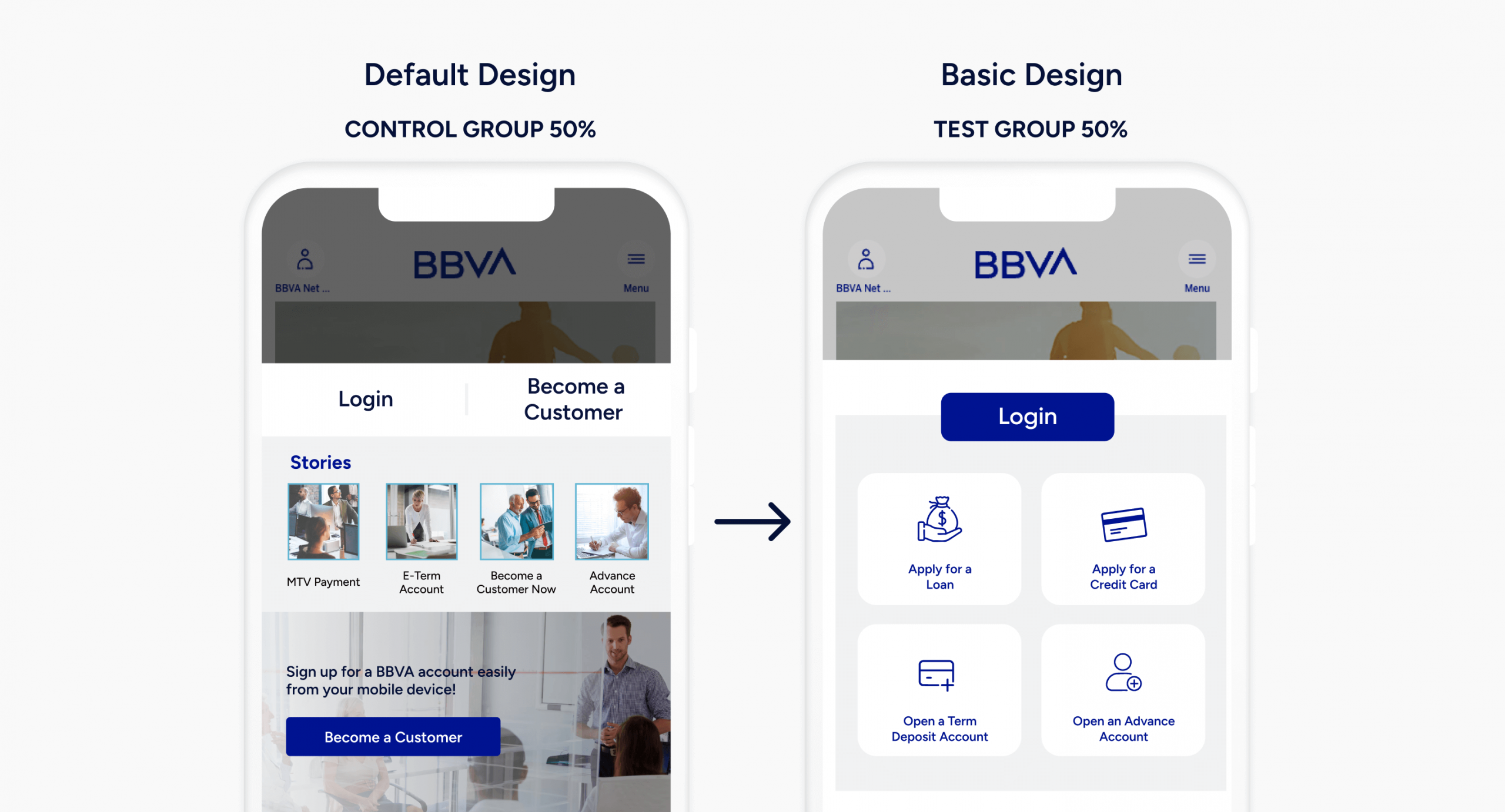

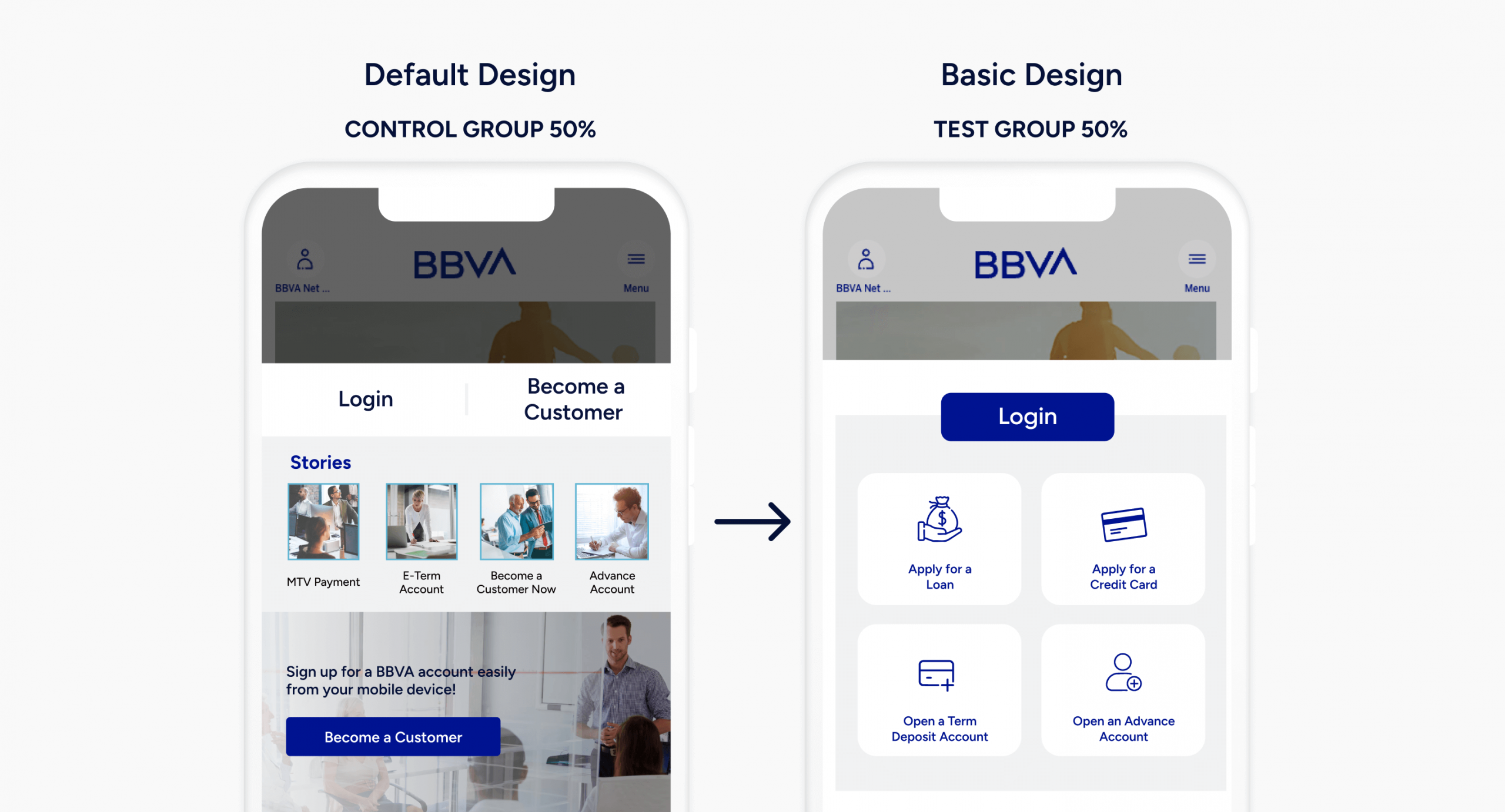

BBVA wanted to increase digital adoption among customers aged 55+, a group often challenged by complex banking interfaces. The bank needed behavioral insights to create simpler, more accessible journeys that would improve engagement and drive higher conversion.

The solution

Using Insider’s Web Personalization, BBVA built a dedicated homepage for the 55+ segment, informed by real-time behavioral data. The interface featured simplified navigation and highlighted the most-used transactions for this group. Through A/B testing, BBVA experimented with layouts, calls-to-action, and flow optimizations. This iterative approach eliminated friction, improved usability, and boosted engagement for older customers.

The results

51%

increase in

search bar usage

20%

increase in logins from the 55+ demographic

“Working with Insider has been a seamless experience. Their account managers not only act on our feedback but also provide strategic guidance to ensure we focus efforts on the highest-impact opportunities. Their deep understanding of the financial services industry’s nuances has been invaluable in shaping experiences that resonate with our customers.”

Sezin Gül Tanrıverdi, Senior Vice President, Digital Banking

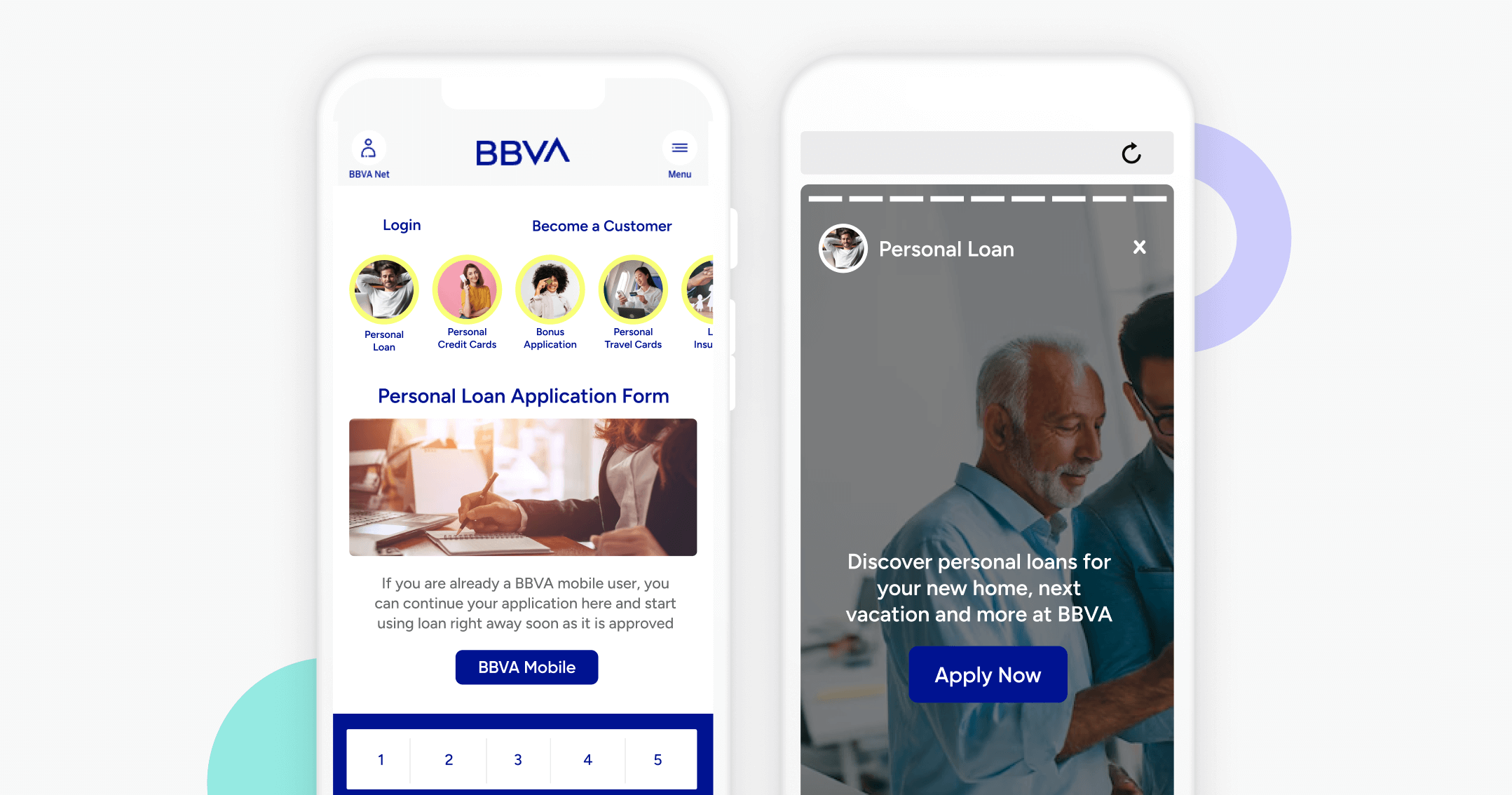

Advanced Segmentation Accelerates Loan & Credit Card Conversions

The challenge

After boosting engagement with customers aged 55+, BBVA set out to improve conversions for its core credit products. The goal was to craft highly personalized journeys that matched each user’s product interests and browsing patterns, delivering timely, relevant offers that would drive applications.

The solution

Using Insider’s AI-powered segmentation and A/B testing, BBVA identified precise micro-segments based on behaviors such as viewed product pages, prior applications, and engagement history. Personalized messaging and exclusive offers for loans and credit cards were presented to each segment at optimal touchpoints. This approach ensured content relevance, boosted click-through rates, and removed friction from the application process, driving significant uplifts in both loan and card conversions.

The results

502%

increase in

loan applications

192%

increase in credit

card applications

20%

more overdraft account opening

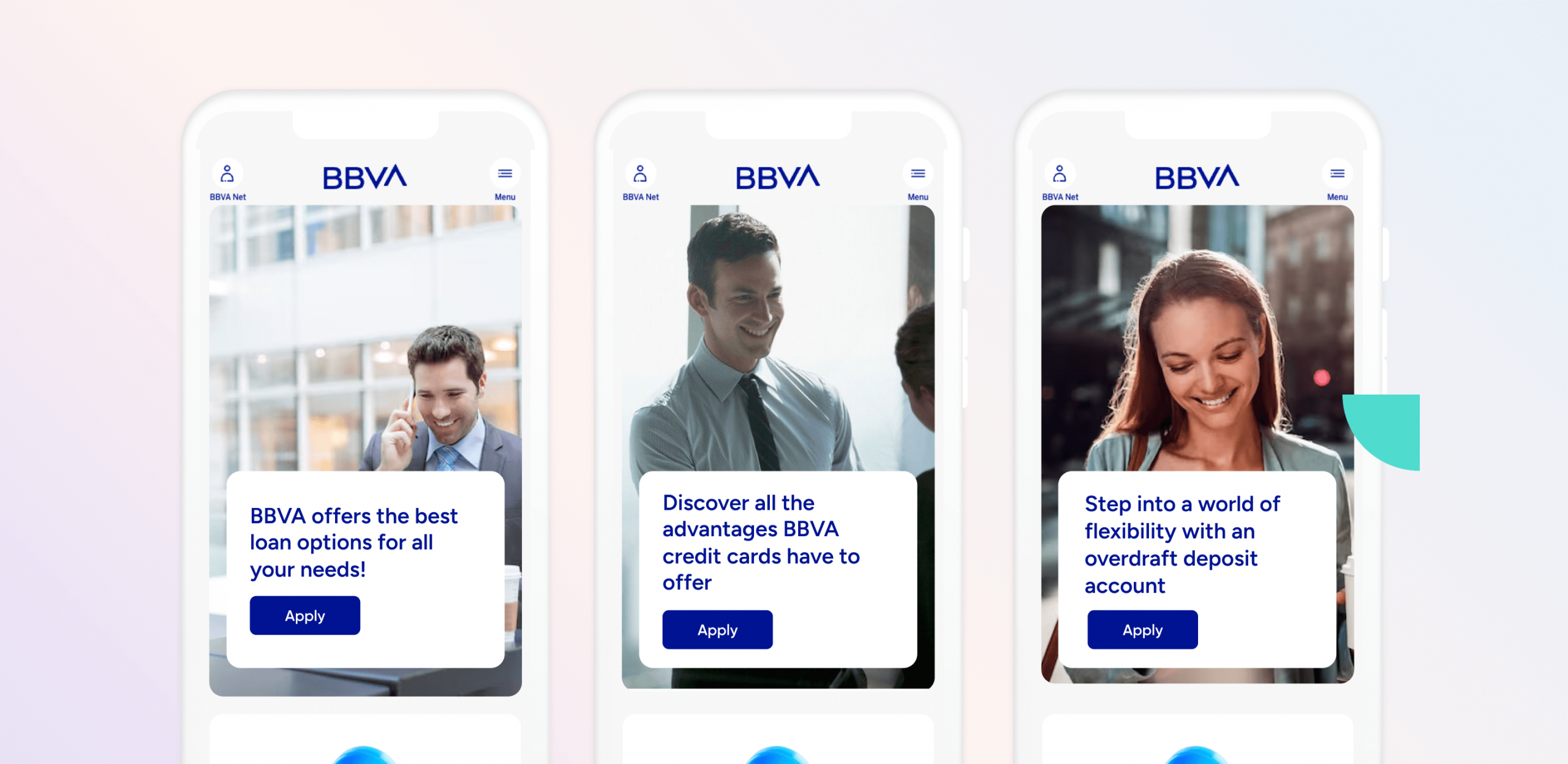

InStory Delivers 6X More Credit Card Applications

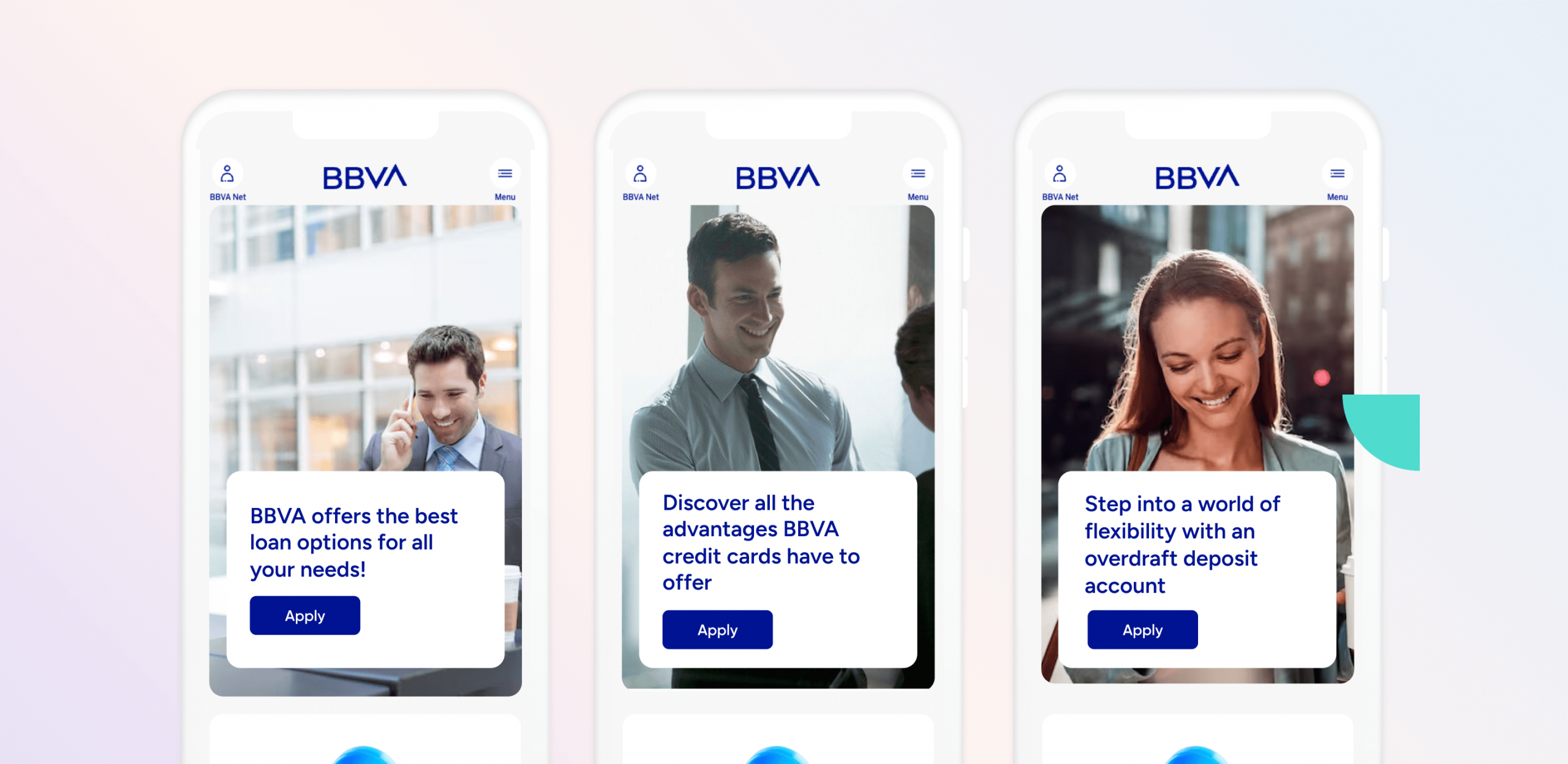

The challenge

To meet mobile-first expectations and appeal to younger customers accustomed to interactive story formats on social media, BBVA needed a visually rich yet intuitive way to promote products on smaller screens, avoiding clutter while keeping the experience fast, engaging, and conversion-focused.

The solution

Insider recommended InStory, transforming BBVA’s mobile web homepage into a dynamic, story-style interface tailored to mobile habits. Six immersive, full-screen stories highlighted personal loans, credit cards, and tax services, mirroring the engaging swipe formats popular on social platforms. Each story led directly to product detail pages, enabling instant applications. This familiar, visually appealing format captured younger users’ attention, improved navigation, and encouraged deeper product exploration without overwhelming the interface.

“Insider has been a trusted partner in helping us design, test, and deliver deeply personalized experiences to millions of customers across web and mobile. With their AI-powered segmentation, on-site experimentation, and innovative tools like InStory, we’ve driven triple-digit conversion uplifts on our key products while creating seamless, tailored journeys. Their commitment to innovation and measurable results has transformed the way we connect with customers and achieve our growth goals.”

Sezin Gül Tanrıverdi, Senior Vice President, Digital Banking

The results

6X

higher credit card application rate

2X

longer time

spent on site

2X

more product

pages per session

Summary

By combining AI segmentation, experimentation, and immersive storytelling formats, BBVA significantly increased engagement, loan applications, and credit card sign-ups, while improving small-screen user experiences. Insider’s unified platform gave BBVA a single source of customer truth, enabling rapid testing, real-time personalization, and omnichannel delivery — all critical for digital success in banking today.

Looking ahead

BBVA plans to expand personalization to other segments, using Insider’s Predictive AI to anticipate customers’ financial needs. Further experiments with emerging formats like InStory will enhance user engagement across mobile-first touchpoints.

Favorite feature

Predictive Segments

BBVA’s favourite feature is Predictive Segments. Insider’s platform allows the bank to combine historical, real-time, and predictive data into a single unified profile, making it possible to target each customer with the right experience at the right time. This capability has been central to driving the bank’s record-breaking conversion and engagement results.

Trusted by over 1,200 global brands

Want to learn what Insider can do for you?